Dad Sparks Debate After Charging Six-Year-Old Daughter Rent

By Maks | Community | 13 August 2025

A father from Texas has started a fiery online debate after revealing the fact that he is charging his daughter of six monthly rent. He claims that the practice is intended as a way to get her ready for the adult life.

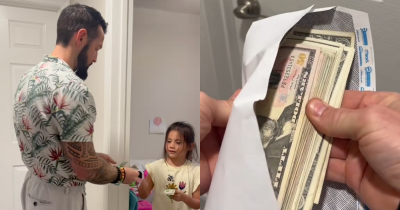

Michael Madden, a 34-year-old territory manager at an electronic distributor within Central Texas, explained on TikTok that he takes part of Rose’s each week “earnings” for what he refers to as rent and utility.

Even though the money isn’t reserved for him, Madden says the idea is to instill an understanding of responsibility and financial knowledge in his daughter at an early age.

A Lesson in Budgeting

Madden is documenting his process on the TikTok profile michael_talksmoney in which he describes the basic system he has used together with Rose.

She earns points by completing daily tasks like brushing her teeth with no the need for reminders, sweeping her bedroom as well as aiding with chores around the house.

When she has reached 25 points over the course of one month, Rose earns $5. If she is able to reach 30, she will receive an extra bonus.

The problem is that Madden demands that about 20% this revenue is earmarked for utilities and rent generally $3 for rental and $1 for utilities.

Instead of securing the cash, Madden saves it for his daughter.

“We don’t take her money,” said the rapper to his fans. “It’s more about demonstrating to how much money you make, and a significant portion of it will go to the needs of your family before focusing on your wants. This is a budgeting lesson in disguise.”

The Viral Reaction

Madden’s style of presentation has drawn a lot of interest, with millions of people watching his videos and thousands of people taking part in the debate.

For some, this method could be considered cruel, as it robs children the right to be free of childhood.

“What’s wrong with being a child and not having to worry about money, rent and utilities?” one critic asked.

Another comment: “Damn. She’s going to be paying for bills for the rest of her life. She’s not even going to be a child anymore.”

Some people suggested that the idea could lead to confusion between financial literacy and stress in adulthood. “Teaching them to pay bills is not teaching about money,” one commenter wrote.

But the reactions have not been all negative. Parents have praised Madden for his creative approach to a challenging topic.

“It’s actually intelligent. She is a young learner. She knows the value of the dollar. Excellent, smart parenting.” one fan wrote to support him.

Another commenter added: “Wait, I wish my parents had done something similar to this. Financial literacy and understanding are crucial.”

Why Teach Money Skills So Young?

The discussion surrounding Madden’s parenting raises the larger question of When is the ideal moment to introduce children to financial accountability?

According to the study from 2022 Cambridge University study, children can comprehend basic concepts about money at seven years old. Habitual patterns of behaviour such as spending, saving and delaying satisfaction are usually formed earlier.

Within the United States, where consumer debt and financial illiteracy are an issue, experts suggest the introduction of money management at an early stage could be beneficial.

The Dr. Laura Levine, president of the Jump$tart Coalition for Personal Financial Literacy stated:

“Children don’t have to be able to comprehend tax codes or mortgages However, they need to be aware of the fundamentals of budgeting, saving and understanding that money is a finite resource. The habits they establish in their early years often influence their financial behavior for decades.”

A Global Perspective

The issue isn’t unique for those in United States. In the globe, strategies for financial education for children differ significantly.

- Japan Japan: Children are frequently given Otoshidama — the New Year’s gifts of money as well as urged to handle these funds on their own.

- Sweden schools integrate financial education into their curriculum starting at the primary stage, with an emphasis on budgeting and understanding the value of work.

- UK The reason is that while parents may give their kids pocket cash, the formal financial literacy instruction is not always taught in schools.

Madden’s strategy may be unique however the idea of introducing children to money at an early age is growing in popularity all over the world.

Experts Divided

There are many experts who disagree with Madden’s strategy.

Psychologist Dr. Jennifer Hart from the University of Texas warned:

“While teaching financial responsibility is crucial however, attaching it too strongly to concepts such as rent at six could be inducing unnecessary stress. Childhood should be primarily an exploration period and peace. There are more gentle methods to attain the same educational results.”

On the other hand the child developmental specialist Daniel Cortez took a more sensible view:

“If the money is saved for her benefit and the parents are honest about its purpose it could be a useful teaching tool. It’s important to ensure that it’s used as a tool for education, not as punishment.”

A Family Perspective

Madden insists that his experiment isn’t about controlling or removing your daughter’s innocence.

When he spoke to people in an interview, he said: “I thought, if she’s going to earn money, it’s also important she learns that not all of it is hers to spend.”

The father is aware that his method may not be suitable for all, but that he wants Rose to be a child with an grasp of money than other adults he meets.

“I’ve seen too many people who reach adulthood without basic budgeting skills,” the man stated. “I don’t want that for my daughter.”

Broader Social Questions

The debate on social media also highlights more general cultural conflicts around parenting in the digital age.

Should parents try out new strategies if they believe that it will benefit their children? Do they increase the risk of turning family life into media for likings and views?

Social scientist Dr. Karen Mitchell suggests the online response reveals a profound discontent:

“People project their own personal experiences with money on stories similar to this. For those who have struggled in the financial realm, the idea of imposing rent on children is a bit unjust. If you’re someone who wishes they’d had the knowledge earlier it’s a good idea. It’s not so much than Rose but more to do with our relationship with money.”

The Unanswered Question

The effectiveness of Madden’s approach remains to be determined. Rose is just six years old, yet her path to wealth is only starting.

What this story demonstrates what is clear, however, is that money is still an extremely contentious topics in the world of parenting.

While viewers debate online and on social media, the main issue remains unresolved. How do you reconcile children’s innocence the requirements of financial knowledge?

At present, Michael Madden continues to record his daughter’s financial education online which has sparked debate in each video.

The rest of us remain to consider what if we had the option, would you have had your parents charge you rent when you were the age of six?